Happy New Year from Skyline Wealth Management.

In case we didn’t get a chance to speak at any investor events through 2023, I am pleased to extend my well wishes for a healthy, happy and prosperous 2024.

As we all continue to navigate through these ongoing uncertain economic and financial times, rest assured that charting these waters is part of our daily routine here at Skyline. Managing and mitigating risk, as well as protecting and strategically growing your wealth is our mandate and responsibility: not only today, but in any economic cycle.

The continued hot topics for 2024? The three “I’s”: inflation, interest rates, and immigration.

Inflation

The Bank of Canada aims to keep inflation at the 2% midpoint of a target range of 1–3% over the medium term. In the latest reporting period (December 31, 2023), Canada’s current inflation rate is 3.4%. Given this reported rate and the Bank of Canada’s impact on managing or influencing CPI, Canadians should expect to see the current inflation rate decline mildly throughout the course of 2024. Current economic indicators suggest that the Canadian economy is slowing after the impact of the 10 rate hikes that the Bank of Canada imposed since March 2022. 1

The impact of inflation on all consumers is clear: all goods are costing more to purchase, as all goods cost more to manufacture.

In our REITS, the cost of providing rentable housing or rentable business space has increased in step with inflation, but on the offset, as the providers of rentable space, we can charge more rent where feasible. Over the mid- to long-term, the REITs’ revenues will, at a minimum, keep pace with its operating expenses, but are more likely expected to outpace them. Real estate investing is a hedge against inflation.

Interest Rates

On January 24 2024, the Bank of Canada announced an interest rate hold at 5%, which has remained unchanged since July 12, 20232. The subsequent interest rate announcements in 2024 are scheduled for: March 6, April 10, June 5, July 24, September 4, October 23, and December 11. While many economists are predicting a rate cut in April, some are predicting a cut as early as March.

As noted above, there have been 10 rate hikes since March 2022, aggregating to a 4.75% increase to date. These rate hikes are a measure used by the Bank of Canada to control inflation. In the real estate industry, these rate hikes can expose real estate owners and investors who were committed to variable rate mortgages and had their mortgage(s) maturing during this period.

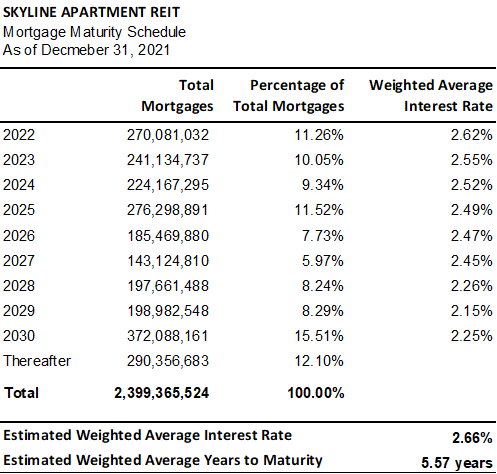

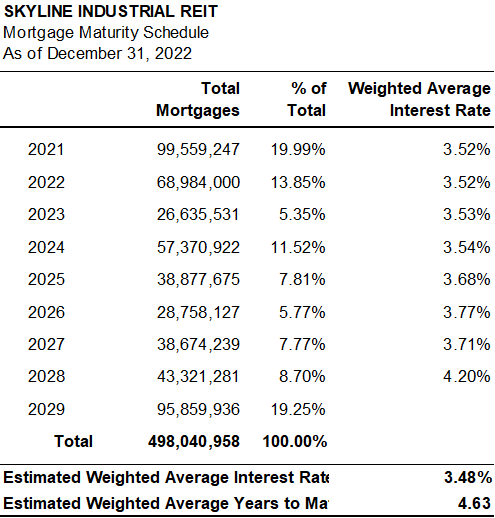

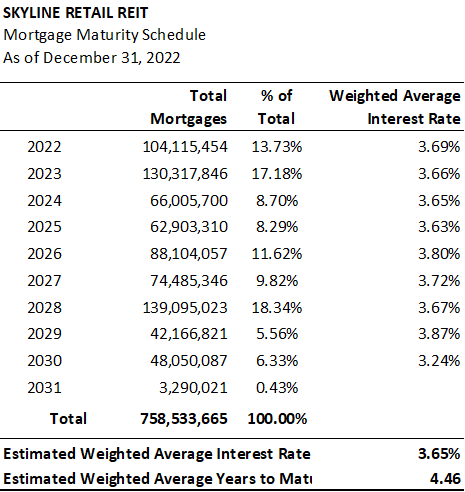

In our REITs, we have always exercised a systematic and diligent mortgage management process. At least 98% of the mortgages across the REITs have been on fixed rates, and we employ a waterfall approach to our mortgage financing, targeting no more than 20% of the REITs’ mortgages to mature in any given year.

Below is a chart of each REIT’s mortgage maturity schedule since January 1, 2022:

Skyline Apartment REIT mortgage schedule As of December 31, 2021

Skyline Industrial REIT mortgage schedule As of December 31, 2022

Skyline Retail REIT mortgage schedule As of December 31, 2022

During this period of rising interest rates, across our REITs, we have had larger top line (revenue) growth than the exposure to higher interest rates, denoting our success in expertly mitigating and managing our interest rate exposure risk.

Immigration

The Government of Canada has set immigration targets for 2024-2026, planning to welcome 485,000 new permanent residents in 2024 and a further 500,000 in each of 2025 and 2026. A higher concentration of immigrants arriving in Canada are post-secondary educated and/or experienced trades people with existing wealth.

The immigration mandate for Canada has a positive effect on all of Skyline’s investment funds: the three REITs as well as Skyline Clean Energy Fund. How you ask?

Multi-residential housing (Skyline Apartment REIT)

The much-talked-about Canadian “housing crisis” encompasses multi-residential (apartment) housing and is not limited to single-family homes and condos. As immigration increases, there is a stress on housing, and Skyline Apartment REIT is poised to provide housing to both new immigrants and current resident Canadians. Currently, Skyline Apartment REIT offers in excess of 22,000 apartment suites; home to over 50,000 Canadians at an average monthly rent of $1,394. At a current occupancy rate of 95.6%, Skyline Apartment REIT is very well-positioned to meet the growing housing needs amidst immigration demands, inflation impact, and the current interest rate climate. While the current average in-place rent is $1,394, the average market rate for the portfolio is $1,784, which is a mark-to-market gap of $373 per suite per month3, demonstrating inherent unrealized portfolio value for our investors.

Essentials-focused retail (Skyline Retail REIT)

Further, recent immigration and population trends are showing that more Canadians are moving out of large urban centres and into secondary and tertiary communities. We have seen growing populations in these secondary markets where we offer apartments, and through our Skyline Retail REIT, we also operate essentials-based retail centres in these markets. As the Canadian population grows through immigration and increases outside of the major metro markets, Skyline Retail REIT has demonstrated the success of its strategy: to focus on everyday essentials-based retail such as grocery and pharmacy—which has displayed much more resiliency than discretionary spending retail (such as fashion) in the recent volatile economic environment. Throughout the pandemic and indeed since its inception, the Retail REIT has delivered strong distributions and stable unit value.

Logistics-based industrial (Skyline Industrial REIT)

Our post-COVID population growth and relocation has increased the need for heightened supply of goods from producers and onto the retailers and consumers. Throughout the pandemic, the industrial real estate sector saw an increased investment on logistics-focused real estate, including warehousing, cold storage, and distribution centres, with an emphasis on “just-in-case” logistics practices.

As Skyline Industrial REIT has completed its strategic dispositions program and redeployed capital into these logistic-focused assets, it is also very well positioned to capitalize on a growing population that is now more widely dispersed, ensuring that supply is at, or closer to the demand sources.

Clean energy production (Skyline Clean Energy Fund)

In addition to immigration mandates, the Government of Canada has also issued energy mandates and green initiatives to promote and accelerate energy production that is cleaner than traditional processes4. As a result, Skyline Clean Energy Fund (SCEF) is also poised for long-term continued demand in its respective sector of energy production. SCEF currently comprises an approximately 50/50 split of solar and bio-gas assets. Where the solar assets produce electricity, under long-term government contracts, the bio-gas assets produce either electricity or renewable natural gas (RNG) under either government contract or private purchaser contracts to energy producers (such as FortisBC) or direct to the energy users.

To summarize – and to wrap together our Skyline Funds – as the Canadian population grows, more housing needs to be built and provided (Skyline Apartment REIT), and more goods must then be supplied and distributed (Skyline Industrial REIT) to essential retail nodes (Skyline Retail REIT); the rising population is also increasing energy demands such as electricity and natural gas, which must also be met in sustainable ways (Skyline Clean Energy Fund).

The Three I’s and Your Investment Decisions

In March 2022, at the time of the first of 10 interest rate hikes, the TSX Composite Index was 21,250.41. Today, January 29, 2024, the TSX closed at 21,200.06; thus essentially a flat return from date to date. However, looking at the details, the market experienced a number of dips – as low as 18,440 on the TSX.

Some analysts have argued that there are higher returns available in the market from dividend-producing stocks or safer investments (such as GICs) producing similar yields in the market – all positioned against Skyline Funds. When the Compound Annual Growth Rate (CAGR) charts for Skyline’s Funds are held up against those of the TSX, Skyline’s investments have historically shown more stability, steady returns, and growth, as well as the potential for tax efficiency benefits. This, in conjunction with the above narrative, should demonstrate the advantageous position of Skyline Apartment REIT, Skyline Industrial REIT, Skyline Retail REIT, and Skyline Clean Energy Fund through the most recent economic cycle and historical cycles – and why holding Skyline Funds as part of your portfolio may help you meet your objectives with historically stable returns with long-term wealth accumulation.

Wayne Byrd

Chief Financial Officer

Skyline Group of Companies

Footnotes

- https://www.bankofcanada.ca/core-functions/monetary-policy/inflation/#:~:text=and%20financial%20welfare.-,Measures%20of%20inflation,consumer%20price%20index%20(CPI).

- https://www.bankofcanada.ca/2024/01/fad-press-release-2024-01-24/

- As at Dec. 31, 2023

- https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/clean-electricity-regulation.html

About Skyline Wealth Management

Skyline Wealth Management Inc. (“Skyline Wealth Management”) is a Canadian investment firm offering a shelf of privately owned and managed alternative investments, specializing in real estate and clean energy assets.

Skyline Wealth Management is the preferred Exempt Market Dealer of four alternative investments:

- Skyline Apartment REIT (Fundserv code: SKY2006)

- Skyline Industrial REIT (Fundserv code: SKY2012)

- Skyline Retail REIT (Fundserv code: SKY2013)

- Skyline Clean Energy Fund (Fundserv code: SKY2018)

Skyline Wealth Management distributes institutional-quality investments to more than 5,800 investors, as well as Canadian investment Portfolio Managers and institutional investors, with ease of access to those who qualify.

To learn more about Skyline Wealth Management and its private investment offerings, please visit SkylineWealthManagement.ca.

Skyline Wealth Management is part of Skyline Group of Companies.

For media inquiries, please contact

Cindy BeverlyVice President, Marketing & Communications

Skyline Group of Companies

5 Douglas St, Suite 301

Guelph, Ontario N1H 2S8

cbeverly@skylinegrp.ca