Key takeaways:

- Registered accounts are key tools for portfolio diversification by minimizing tax and allowing income to grow on a tax-deferred or tax-free basis.

- Return of Capital is a key strategy within certain alternative investments for achieving tax deferral benefits.

- Private market investments can enhance tax efficiency within a well-structured, diversified portfolio.

You’ve helped your clients choose solid investments. But are those investments sitting in the right accounts? Tax efficiency in a diversified portfolio isn’t always what your clients own, but where they own it. Using effective account shelters, advisors can help clients postpone capital gains taxes and allow their assets to compound more effectively over time. This applies especially to the strategic positioning of private alternative investments in a portfolio, which can offer special tax advantages that public market vehicles like equities and bonds often lack. This simple shift in mindset could lead to a real impact on long-term returns.

In this article, we explore how different account types and private investment options can help boost your client’s overall portfolio tax efficiency. We’ll also break down the unique benefits of Return of Capital (RoC)—a key tax-deferral tool often found in private investments like real estate investment trusts (REITs).

Strategic Allocation Begins with Account Type

A strategic allocation of alternative investments typically incorporates a blend of both registered and non-registered accounts, with registered accounts typically prioritized up to their contribution limits. As we will examine, both account types provide unique benefits that can be strategically utilized to improve tax efficiency within a portfolio.

A registered account is a government-offered investment shelter that offers tax-free growth to facilitate long-term saving objectives. Registered accounts differ from non-registered accounts since investment gains accumulate either tax-free or tax-deferred, depending on the plan. Taxes are typically deferred until capital is distributed and capital compounds more efficiently without the immediate payment of tax.

One of the most common tax-deferral strategies using a registered account involves an RRSP (Registered Retirement Savings Plan). Contributions to this plan are tax-deductible, which reduces your client’s taxable income for the current year. Any investment growth within the RRSP, whether from interest, dividends, or capital gains, is tax-deferred until funds are withdrawn, or until an RRSP is forcibly rolled into a Registered Retirement Income Fund (RRIF). The idea is that money can compound tax-free in investment vehicles and withdrawn when the client is in a lower tax bracket during retirement.

Conversely, a non-registered account refers to any investment account that has not been registered with the federal government for specific tax benefits. Although these accounts do not typically provide tax deferral or tax-free growth, they can provide substantial benefits for select alternative investments and trust structures.

| Registered Account | Non-Registered Account | |

| Contribution Limits | Yes | No |

| Tax on Growth (realized capital gains) |

Tax-free or tax-deferred | Taxed annually |

| Taxation on Withdrawal | Taxable upon withdrawal or tax-free in some cases | Income is taxed annually regardless of capital withdrawal |

| Investment Income Tax (investment income generated) |

Not taxed annually | Fully or partially taxed annually |

| Capital Loss Use | N/A | Tax-loss harvesting can be used to offset gains |

| Reporting Required | Not required by the investor (info collected by CRA) | Investor must report all gains and losses to CRA |

Despite the clear advantages of registered accounts, apart from their contribution limits and the inability to offset capital losses, non-registered accounts offer a key benefit that advisors focused on alternative asset allocation should not overlook.

Leveraging Return of Capital (RoC) inside non-registered accounts

We’ve covered how registered accounts provide strong tax-deferral benefits that enhance compounding of investment income, but what is the tax treatment of return of capital? Although non-registered accounts offer fewer tax advantages due to mandatory annual reporting and taxation, it can provide important tax deferral benefits like those of registered accounts. If RoC isn’t currently part of your client’s portfolio strategy, it’s a strategy worth considering.

RoC is the money your client receives back from an investment that isn’t considered profit or income. Instead, it represents a portion of the original capital your client originally invested in the fund. As it represents a return of principal rather than profit, RoC isn’t taxed in the year it is received.

This structure is most common in REITs, infrastructure funds, and energy partnerships. These types of funds own physical assets that lose value over time (like buildings or equipment). That depreciation helps reduce their taxable income, allowing them to pay out more cash to investors than they report as earnings. The excess cash is classified as RoC and distributed to investors through structures that are legally required to pay out all of their income.

The key benefit is that payments are not taxed in the year received, allowing your clients to reinvest these funds into other income-generating investments. Instead, it serves to decrease a client’s Adjusted Cost Base (ACB), postponing tax obligations until the investment is sold.

Below is a simple example showing how RoC works alongside a Dividend Reinvestment Plan (DRIP) to help reduce present-year taxable income.

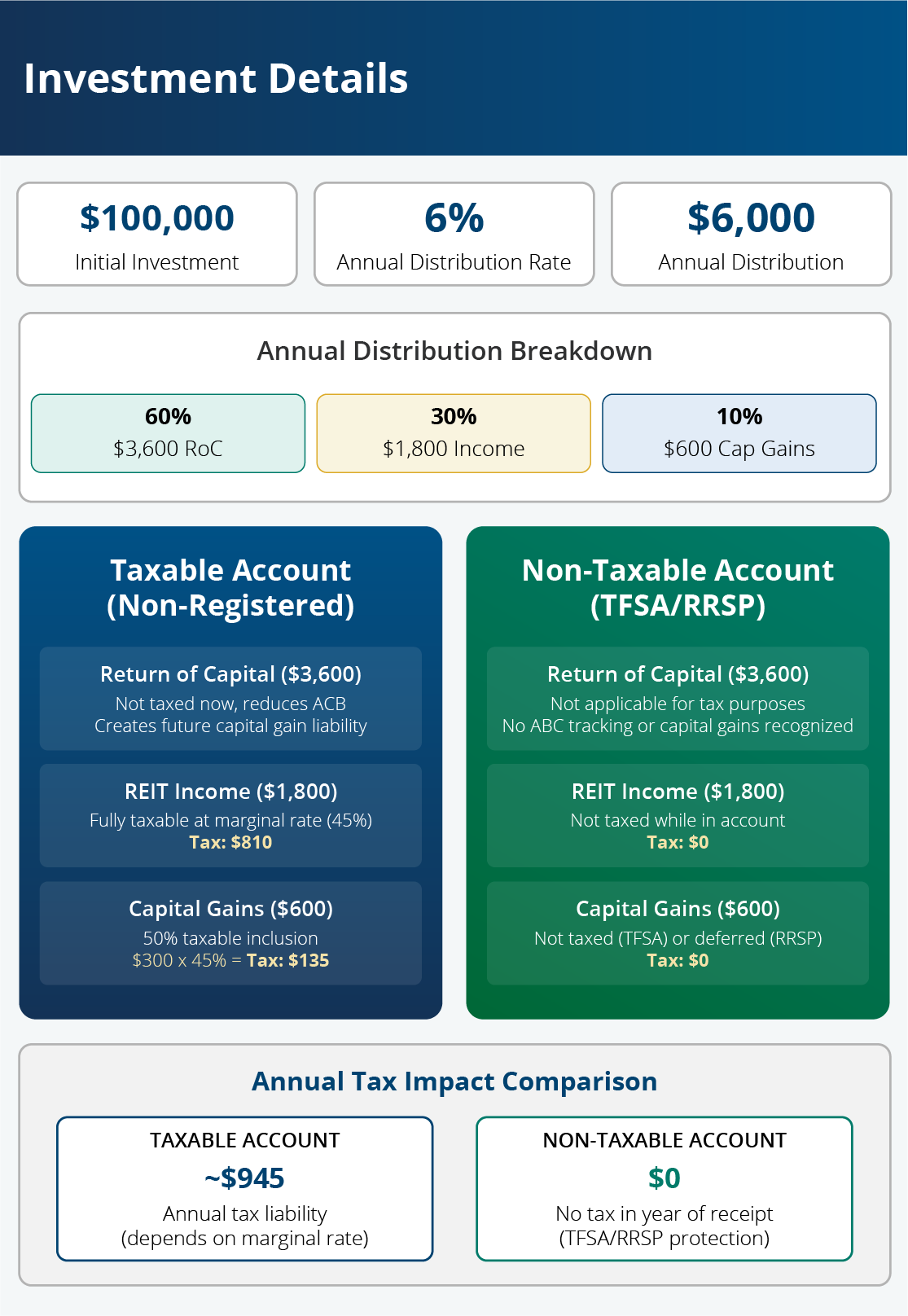

Expanding upon the basic RoC example to include a non-registered account emphasizes its primary benefit: RoC is the sole component of income that offers tax deferral in these accounts. Conversely, registered accounts continue to be the most tax-efficient options overall, since all gains and income are protected from taxation as long as they stay within the account.

Let’s walk through an example of distribution REIT RoC tax treatment within registered and non-registered accounts:

One of RoC’s greatest strengths is its ability to adapt across different private investment types and tax strategies. It can serve as a standalone source of tax-free income until the ACB is fully depleted or be used alongside other income sources to help lower an investor’s taxable income. It can also provide complementary benefits to existing revenue streams by:

- Reducing current taxable income in Old Age Security (OAS) and other income-producing streams. Below is an example of how RoC reduces the tax burden for a client with $60,000 in annual income and just below the OAS clawback threshold:

Investment Amount Invested Example Annual Distribution Taxable Income OAS Impact Interest Income $100,000 6% → $6,000 $6,000 Increases net income to $66,000 → no clawback but closer to threshold Skyline REIT (60% RoC, 40% income) $100,000 6% → $6,000 $2,400 Net income of $62,400 → preserves more OAS room - Reducing the taxable portion of a client’s investment income, which is taxed at half the rate of regular income.

- Heirs may benefit from a cost base reset on inherited non-registered investments, including those that distributed RoC during the original owner’s lifetime.

- Helps preserve taxable income levels, as RoC distributions in non-registered accounts aren’t considered income and therefore don’t affect registered account contribution limits.

Advisors must be aware of the impact of ROC on an investment’s adjusted cost base to their clients, which typically increases total capital gains (or reduces your capital loss) when the investment is sold. This can lead to a greater tax liability upon future asset disposition, or once the capital the client receives begins to exceed their original investment.

RoC also provides no added tax benefit within registered accounts where investment income already grows tax deferred. Ultimately, it is suitable for income-oriented investors who want tax-deferred cash flow within a non-registered account.

Other alternative investment options to help maximize tax efficiency

While RoC serves as a core tax deferral mechanism in certain private investments, it is by no means the only one. Asset allocators have access to several alternative investment strategies that can be employed to enhance after-tax outcomes and reduce clients’ overall tax burden in Canada. Outlined below are select notable options, which serve different roles depending on the investor’s profile and objectives:

Mortgage Investment Corporations (MICs)

Mortgage Investment Corporations, or MICs, are specialized tax-benefited Canadian companies governed by Section 130.1 of the Income Tax Act. They pool investor capital—typically in preferred share issues—to invest in short-term commercial and residential mortgage financings, typically offering more lenient credit terms than traditional financial institutions. Similar to most REITs, MICs are legislatively required to distribute all net income to stockholders and thereby do not pay corporate income tax themselves.

Though MICs invest and source primarily in Canadian residential mortgages, they can invest in other asset-backed lending opportunities as well. The interest income on the mortgage interest is paid to investors as interest income, and not dividends. As investment funds that are public or private, MIC should be regarded for registered accounts where the interest income is either tax-deferred or tax-free depending on the type of account.

Note that MICs are less tax-efficient than RoC in non-registered accounts, where interest income is subject to the full marginal tax rate and does not qualify for dividend tax credits. In the absence of RoC eligibility, this removes a primary tax deferral mechanism that REITs typically provide.

Private Equity Funds (PEF)

PEFs structured as LPs are widely used by qualified, institutional, and high-net-worth investors to access long-term growth opportunities in venture capital, buyouts, growth equity, and private businesses. In addition to their potential returns, they provide substantial tax efficiency benefits, especially when compared with traditional public investments.

Because they are flow-through vehicles, LPs pass through income, capital gain, loss, and deductible expenses directly to investors, thereby avoiding fund-level taxation and double taxation. Exits from portfolio companies are typically taken in the form of capital gains, which are subject to a lesser inclusion rate than interest or dividend income.

Eligibility is primarily restricted to accredited investor opportunities, with minimums typically ranging from $250,000 to in excess of $1,000,0000.

Capital Dividend Account

Corporate accounts, especially Canadian-controlled private corporations (CCPCs) that use a capital dividend account (CDA), offer a smart way to invest while minimizing tax liability.

When a CCPC makes a capital gain, 50% of that gain, which is the non-taxable portion, goes into its CDA. This allows tax-free dividends to be paid to corporate shareholders. They can benefit from part of the capital gain without having to pay extra personal taxes. It’s important to remember that capital dividends can only be distributed up to the CDA balance, otherwise, penalty taxes will apply.

As a result, the CDA is commonly used in estate planning and corporate investment to extract capital from a corporation in a tax-efficient manner. It serves as a key tool for estate planning, especially when children are shareholders. This process helps make wealth transfer more efficient and reduces the overall tax burden on the estate.

How private alternative investments offer unique tax advantages

While core tax efficiency strategies can sometimes apply to both public and private investments, the application often differs in practice. Private alternative investments present distinctive income structures, legal frameworks, and reporting standards, creating opportunities for advisors to implement customized portfolio placement and tax optimization strategies.

With more than 25 years of expertise, Skyline supports advisors in enhancing their clients’ portfolios with tax-efficient private investments. Our REITs are designed to offer consistent RoC distributions, ensuring dependable cash flow and significant tax deferral advantages.