Key takeaways:

- Private alternative investments have demonstrated the ability to enhance returns while reducing investment volatility over time.

- The compounding effect of tax-deferred savings and disciplined return management can rival even the strongest growth strategies.

- Recent public market returns have far outpaced historical norms, driven by elevated valuations that suggest today’s performance is unsustainable over the long term.

In today’s world of round-the-clock trading and extreme market swings driven by breaking headlines, it’s easy to get caught up in the hype and lose sight of your investing goals. While some investors may find it tempting to chase equity market returns when times are good, consider that when equity markets rise, valuations often get stretched, which can increase downside risk if prices revert to more normal levels. As legendary economist Milton Friedman famously noted, There’s no such thing as a free lunch,

reminding investors that big returns are unsustainable and usually come with substantial risks.

This is precisely the environment investors are facing today. Outsized multi-month gains in North American equity markets have created the expectation that such outperformance can last indefinitely—even tempting some investors to chase returns. But is it wise to alter your long-term investment plan to pursue short-term rewards in an increasingly speculative and volatile environment?

The answer lies in the power of a well-structured, long-term investment approach—the kind that builds and protects wealth over generations.

Private market investments are a trusted path to long-term wealth growth

Many investors are coming to appreciate that private alternative investments can offer more stability and better performance potential than commonly assumed. These investments aren’t about taking big risks on assets that produce uneven returns. In reality, instruments like private real estate investment trusts (REITs) have built an extraordinarily strong track record for helping investment accounts grow over time. They not only have the potential to outperform public equities but can reduce portfolio volatility, hedge against inflation, and provide better risk-adjusted returns. This trend is well-supported by historical data.

For example, for twenty years between 2004 and 2023, U.S. private equity and venture capital generated more than double the returns of the S&P 500. It has also been documented that an equal-weight allocation to private alternative asset classes delivered returns about 4% per year higher than an equal-weight allocation to traditional public asset classes, excluding cash.

This exemplary track record is consistent with Skyline’s flagship fund, Skyline Apartment REIT, which has not had a unit value decline since inception in 2006 (as at June 30, 2025). On the infrastructure side, the Skyline Clean Energy Fund has not experienced a unit value decline since its inception in 2018 (as at June 30, 2025). This consistency has made Skyline investment products a valuable addition to many diversified portfolios, offering investors an effective way to mitigate risk without sacrificing performance.

The tax-smart advantage of private REITs

The timeless adage, Preservation is the first return,

is often overlooked, yet it remains as relevant today as ever. While focus is often hyper-fixated on returns generated from an asset, shouldn’t as much emphasis be placed on how much of those returns investors actually keep? After all, disciplined savings and careful management of returns can have a compounding effect that rivals even the strongest growth strategies.

This is where the concept of Return of Capital (ROC) comes in. This is a portion of private REIT distributions that are not immediately taxed but instead reduce the adjusted cost base of your units, deferring taxes until you sell. In contrast, public REIT distributions and equity dividends are taxed in the year they are received, meaning you pay tax immediately on a portion of returns rather than deferring it.

The table below provides a basic illustration of how each $1,000 investment is taxed in a non-registered account in practice, based on Ontario’s highest marginal tax rate:

| Component | Taxable Portion | Tax Rate | Tax | Tax Credits | In Your Pocket |

|---|---|---|---|---|---|

| Interest Income | 100% | 53.50% | $535 | $0 | $465 |

| Eligible Dividend Income | 100% | 53.50% gross | $535 | $214 | $781 |

| Capital Gains | 50% | 53.50% | $268 | $0 | $732 |

| *Return of Capital | 0% | 0% | $0 | $0 | $1,000 |

By deferring taxes through ROC, investors can reinvest more of their cash flow today, allowing that capital to continue compounding. This tax-deferral feature gives private REITs a unique advantage over investments that are taxed immediately. It’s a strategy that rewards patience, helping investors build greater long-term wealth over time.

How sustainable are today’s public market returns?

Since 2019, North American equities have produced unsustainable returns. For example, an equal-weight buy-and-hold portfolio among major indexes (TSX Venture, TSX, S&P 500 and NASDAQ) has generated a consolidated return of 22.1% per year through January 1, 2023 to September 26, 2025. To put this in perspective, the S&P/TSX Composite has delivered an average annual return of roughly 6.5% since 1945, while the S&P 500 has averaged about 8% per year since 1928.

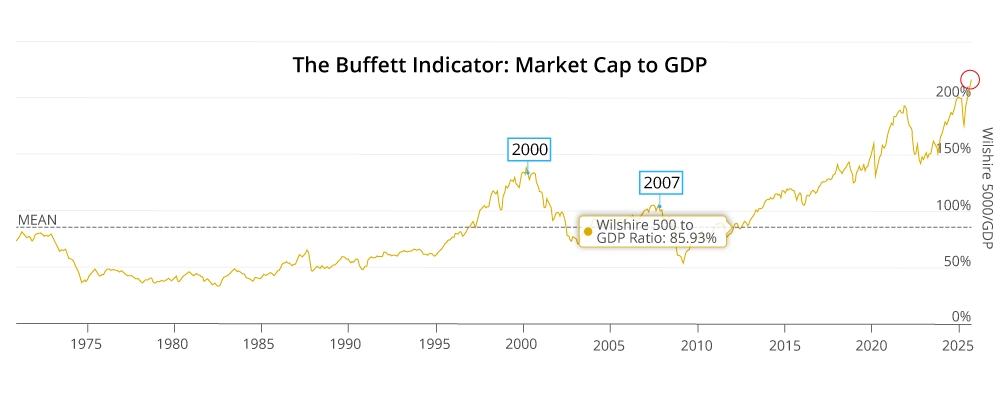

Meanwhile, valuation metrics such as price-to-earnings ratio in U.S. equities show markets trading well above historical averages. The renowned Buffett Indicator, a valuation gauge that compares the total market capitalization of a country’s publicly traded stocks to its gross domestic product (GDP), shows that U.S. equities are valued at more than twice the size of the national economy. In simple terms, public equities are expensive and are priced well above their historical norms.

Choosing which assets to invest in is just one aspect of investing—rotating out of overvalued assets into dependable, cash-flowing investments is equally important. Successful investors like Warren Buffett focus on relative value between assets and sell those that become too expensive. Those who ignore these principles risk leaving their capital exposed as money flows toward better risk-adjusted opportunities.

The bottom line

Today’s environment is reminiscent of a ‘tortoise versus the hare’ investing scenario. While the hare races ahead chasing quick gains, the tortoise stays the course, sticking to a disciplined, proven strategy and resisting the lure of short-term distractions. In the end, the tortoise understands that by staying focused on its long-term investment goals, it will win the race.

That’s why Skyline has designed its funds with this long-term vision in mind. Each aims to provide stable returns and consistent income by owning asset classes with durable tenant demand even in uncertain economic environments. These property portfolio sectors, such as multi-residential real estate, logistics, essential retail, and renewable infrastructure, provide real value through tangible assets and bring balance to portfolios exposed to the premium pricing of public markets.

portfolio of real estate