Key takeaways:

- Compounding interest can accelerate the achievement of your wealth growth goals by earning interest on the principal investment amount as well as any historical earnings.

- You can maximize your earning potential by investing early, investing often, and reinvesting any returns.

- Leveraging private alternative investments, like real estate investment trusts (REITs), and combining them with registered savings accounts can boost the power of compounding with reinvestment and tax efficiencies.

Your money is the most valuable today than it will ever be. As Harvard Business School explains, money you have in hand today is at its peak value because it still holds its full potential of earning, it has not been depreciated by inflation, and is certain, unlike projected earnings. Capitalizing on that peak value by harnessing the investment superpower of compound interest, combined with leveraging private alternative investments—like private REITs—can supercharge the potential earning power of today’s money.

What is compound interest?

Compound interest is the cumulative amount of interest earned on both your original principal investment and any earnings previously added to it. Essentially, it’s a “growth on growth” effect that lets you earn money on the capital you have invested, as well as any earnings that same capital may have gained historically.

Compound interest vs. simple interest: Make your money work harder

Not all interest is created equal. Simple interest is only applied to the principal investment amounts, with no distributions or interest earnings reinvested, resulting in a slower, linear growth. Conversely, compound interest can accelerate your earnings over time, as it applies to both the principal interest amount and any historical earnings, thereby compounding your potential overall growth.

Let’s look at how the value of these different earning types compare, using an example of an initial $50,000 investment at an assumed 5% annual interest rate:

- Simple interest: You would earn $2,500 every year during the lifespan of your investment. At the end of five years, your investment would be worth $62,500—your initial $50,000 investment, plus the $12,500 in interest earned.

- Compound interest: By reinvesting your earnings each year, your money would earn interest on interest. Over the same five-year period, your investment would be worth $63,814, an extra $1,314, just from compound annual growth working for you.

While the difference in earning potential may seem small over five years, the benefits of compound interest over time are clear, especially when you consider the growth that could be realized over decades and combine that with investments that offer historically consistent returns.

How to maximize compound interest

To truly maximize your earning potential with compound interest, there are three key variables you should consider when choosing your investments:

- Compounding frequency: Increasing the number of compounding periods, or the times during the investment lifecycle when interest is calculated and deposited back into your investment account, can, in turn, increase your compound interest earnings. For example, if the same 5% interest rate from the example above was compounded monthly instead of annually on your $50,000 investment, your investment would grow by 28.34% instead of 27.63%.

- Time in market: The longer you invest your money, the greater the earning potential of your investment. Going back to your $50,000 investment, after five years it would be worth $63,814, but after 15 years, it would be worth $103,946, a 107.9% increase from our initial investment.

- Amount invested: Increasing the amount of principal that you invest, even in small amounts, consistently over time, can exponentially increase the earnings on your investment. If you invested an additional $1,000 each month, on top of your initial investment of $50,000, after monthly compounding at 5% interest, in just five years your investment would be worth $132,174, 136% more than if you had just kept the principal amount the same.

As you can see, small adjustments to your investments can make a big impact on your overall earning potential.

How compounding works within a REIT

The real potential of compounding lies in funds that allow reinvestment, like private real estate investment trusts (REITs). These powerful investment tools can allow you to harness the power of compounding, ensuring you are positioned to realize all of the potential growth you can to reach your goals, grow your wealth, and protect your financial future and legacy.

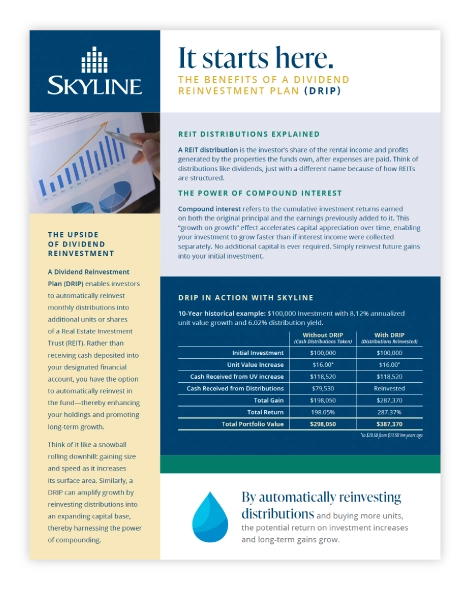

Specifically, private REITs are structured to pay out distributions regularly to investors from income generated from their properties, as applicable. As an investor, you can have those distributions deposited directly into your financial account of choice, allowing you to access the cash right away, or alternatively, you can reinvest the distributions in a Dividend Reinvestment Plan (DRIP), and harness the power of compounding dividends (or in the case of a REIT, distributions).

Essentially with a DRIP, distributions earned are reinvested to purchase more REIT units without you having to invest any more capital, effectively enhancing your holdings and your potential earnings. Those new REIT units are then able to earn their own distributions, which could then be reinvested as well, continuing the cycle and creating a snowball-growth effect on your investment’s overall value. It’s a smart way to harness the power of compounding and has the potential to turn your passive income into lasting, long-term growth.

Learn more on how reinvesting distributions can boost growth; download Skyline’s free DRIP resource today:

Pick the right investment vehicle for your goals

As with all investments, choosing the right product for your goals and overall risk tolerance is the first step. Savings instruments that can help you grow your wealth with compounding interest or distributions are plentiful, but not all are structured equally, and vary in their risks and returns. You can consider non-registered investment accounts, like cash and margin accounts, as they provide the ability to make unlimited contributions (and withdrawals), but there are tax implications on capital gains that need to be considered.

Registered accounts, such as RRSPs, TFSAs, RESPs, FHSAs, LIRAs, and RRIFs, offer tax benefits and provide opportunities to grow wealth through tax-deferred or tax-free compounding. Because earnings are sheltered from immediate taxation, every reinvested dollar works harder over time, accelerating long-term growth. These accounts are generally more stable and can help protect your investments from short-term market fluctuations, though they come with contribution limits and withdrawal restrictions.

Regardless of account type, consider diversifying your investments within each account to spread risk and capture income from multiple sources. This helps maximize growth potential while maintaining stability over time.

Bottom line

Compounding interest and reinvesting your distributions can unlock greater earning potential for your investments. You can maximize your prospective wealth growth by investing early, investing regularly, and investing for the long-term with compounding returns.

Skyline’s professionally managed REITs—Skyline Apartment REIT, Skyline Industrial REIT, and Skyline Retail REIT—can all harness the power of compounding interest, offering geographic diversity across multiple assets and complete professional management to give you peace of mind.

Book a complimentary meeting with a Skyline Wealth Management expert to learn how our private alternative investments can help you access compounding interest, the investment superpower.

[i] The Rule of 72 is an estimate of return on investment that is best used for demonstrating the power of compounding and quickly comparing investments. The rule uses past performance to estimate the rate, which is not a guarantee of future results, and assumes that the rate will stay stable over the full term of the investment. It also does not take into account market conditions, inflation rates, or economic performance. The Rule of 72 is most accurate when working with interest rates between 6% and 10%. For lower rates, subtract 1 from 72 for every 3 points lower than 8% (e.g. use The Rule of 71 for 5%). For higher rates, add 1 for every 3% higher than 8% (e.g. use The Rule of 73 for 11%). The Rule of 72 is no substitute for expert financial planning, research, and advice.