Summary

Skyline Wealth Management explains the importance of building generational wealth and how to leverage real estate to build a lasting legacy.

Jump to:

- Potential Benefits of Generational Wealth Transfer

- How Real Estate can Help Build Generational Wealth?

- Potential Benefits of Private REIT Investing to Help Build Generational Wealth

- Significance of Building Generational Wealth in Today’s Economy

Generational wealth transfer refers to the act of passing on accumulated assets, investments, and wealth from one generation to the next.

The accumulation of generational wealth requires strategic investing over several years alongside wealth planning, not just for the investor but also for the intended beneficiary of that wealth. Through intergenerational wealth planning, the younger generation can be equipped with the tools and resources needed to continue building a financial legacy.

Despite the importance of building generational wealth, a survey by Edward Jones found that nearly 73% of Canadians over the age of 45 have not started planning for intergenerational wealth transfer, with 32% admitting procrastination as a main reason, and an additional 29% reporting that they did not know where to begin.1

Potential Benefits of Generational Wealth Transfer

Beyond the accumulation of financial assets, generational wealth transfer offers several advantages that extend far beyond mere monetary value:

Potential Tax Benefits: By structuring and holding funds in tax-advantaged accounts, such as a Tax-Free Savings Account (TFSA) or other tax-efficient investment vehicles, individuals can ensure that the wealth they intend to pass on remains untaxed or minimally taxed. In the case of a TFSA, any gains earned on investments held within the account are entirely tax-free. This allows the wealth to grow and compound over time without the burden of capital gains taxes.

Sharing Wealth and Experiences While Alive: Engaging in living inheritance through gifting provides an opportunity to share experiences and resources while fostering closer family ties. By giving monetary gifts or transferring assets to family members or charitable organizations, individuals can experience the impact of their wealth and actively participate in shaping their legacy. Moreover, gifting assets during one’s lifetime may offer certain advantages from a tax perspective.

Peace of Mind through Proper Estate Planning: Comprehensive estate planning ensures that individuals’ estates are organized, managed, and distributed according to their wishes after they pass away. Proper estate planning allows individuals to create a detailed roadmap for the transfer of wealth by designating specific assets or financial resources to beneficiaries. This ensures that loved ones receive their intended inheritances while minimizing potential conflicts and disputes among family members. Investors are strongly encouraged to consult with a professional advisor who may assist in determining the most suitable investment strategy and best practices to accomplish an investor’s specific generational wealth goals.

How Real Estate can Help Build Generational Wealth

Real estate and generational wealth often go hand in hand. Real estate is a tangible asset that typically has a simple transfer process for succeeding generations, making it an attractive investment option.

Many individuals consider investing in Real Estate Investment Trusts (REITs) as an alternative to more traditional real estate investing methods such as individual property ownership. REIT investments, which can be classified as privately or publicly held, may present the same benefits as traditional property investments—without the potential unexpected costs and challenges that can accompany property management. REITs may also provide an opportunity to invest in institutional-quality real estate that most individual investors cannot otherwise access.

Potential Benefits of Private REIT Investing to Help Build Generational Wealth

Some types of investments may offer particular benefits and advantages that align with an investor’s objective of building wealth to pass on to future generations.

Private alternative investments, such as private REITs and private equity growth funds, may offer steady and above-average returns when compared with their publicly traded counterparts and may therefore be a suitable option for investors to consider as a method to create generational wealth.

Investing in private alternative investments such as private REITs can present several potential advantages, including:

- Diversification: Private REITs offer access to a diverse range of institutional-quality real estate asset classes, which may present different return profiles and risk characteristics. This helps mitigate risk by reducing the potential negative impact of a single investment or market event on an investor’s overall portfolio. Each of Skyline’s REIT investments specializes in a particular asset class, focusing on the geographic diversification of properties across Canada.

- Steady income stream & potential for compounding returns: Private REITs can provide passive income through regular distributions, which can help build wealth over time. Each of Skyline’s REIT investments has historically provided investors with monthly distributions with the option to participate in a Distribution Reinvestment Plan (DRIP), which allows distributions to be reinvested back into the REIT with the objective of compounding returns.

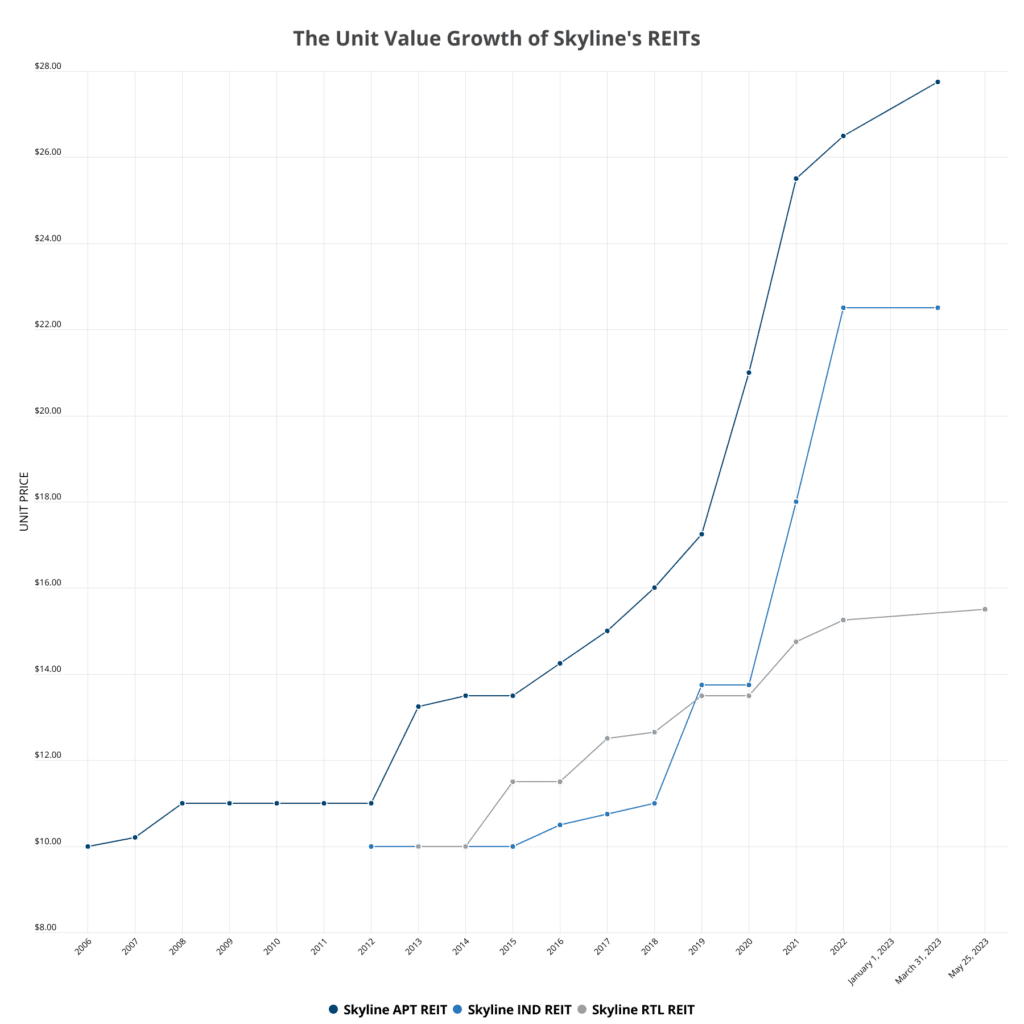

- Capital appreciation: Private REITs also offer the potential for capital appreciation over time as property values increase, providing an asset that can be passed down to future generations. Skyline’s REIT investments have each seen historical growth and increases in Unit Value and Distribution per Unit since inception.

- Hedge against inflation: Investing in a private REIT may help an investor’s overall holdings outpace the rate of inflation; this is especially important as the investor approaches retirement. Investors in Skyline’s REIT investments have benefited from historically stable and growing returns since as early as 2006, helping them accumulate wealth even through market downturns and inflationary periods.

- Access to private market opportunities: Private alternative investments, especially private REITs, can provide individuals access to exclusive investment opportunities that would not otherwise be available to them, such as off-market deals or development projects. Skyline’s REIT investments offer investors access to institutional-quality apartments, industrial and everyday essentials (such as grocery and pharmacy) anchored plaza retail real estate.

Skyline Wealth Management offers three private alternative investments: Skyline Apartment REIT, Skyline Industrial REIT, and Skyline Retail REIT. Each REIT is specialized in a different real estate asset class: multi-residential, industrial, and retail—and each REIT has seen historical growth and stability since inception.

The Significance of Building Generational Wealth in Today’s Economy

Economic shifts can result in a generational wealth gap that may leave younger generations unable to maintain a similar lifestyle to that of their parents and grandparents. According to a 2022 Statistics Canada study, the top 20% of the wealthiest Canadian households claim 67.1% of the country’s wealth, with the least wealthy households claiming just 2.8%.2 These statistics illustrate a significant wealth gap that exists in Canada.

Building generational wealth is especially significant in the current market environment, as Canadian generations are facing challenges such as increased cost of living and decreasing housing affordability. According to Statistics Canada, the Consumer Price Index (CPI) rose 6.8% on an annual average basis in 2022, which is a 40-year high since 1982 (+10.9%).3

Generational wealth distribution that has been properly planned and structured can potentially help close the wealth gap, as well as combat the rising costs and income inequality in today’s economy. Through building and distributing generational wealth, investors have the ability to make a lasting positive impact not only for their own family but also for younger generations of Canadians. Investors with this objective may find particular advantages to investing in private alternative investments to help mitigate risk and diversify their portfolios while enhancing their returns.

Final Thoughts

Through building generational wealth, investors can create a financial legacy that can last for generations and potentially help younger generations combat economic challenges such as increased cost of living. Private alternative investments like private REITs may assist investors in achieving stability and greater returns in their portfolio, so that they can reach their wealth building goals.

When considering investment options to build generational wealth, it is important for investors to consult a wealth or tax professional to build a suitable plan that aligns with their specific investment objectives.

Connect with a Skyline Wealth Management representative today to learn more about how private alternative investments, including private REITs, may be a suitable fit for investors looking to build generational wealth through real estate.

[1] Staff. (2021, November 16). More Canadians are looking to pass on inheritance early, study finds. Advisor’s Edge. www.advisor.ca

[2] Government of Canada, S. C. (2022, October 3). Distributions of household economic accounts for wealth of Canadian households, second quarter 2022. The Daily – . Retrieved April 18, 2023, from www150.statcan.gc.ca

[3] Government of Canada, S. C. (2023, January 30). Consumer price index: Annual Review, 2022. The Daily – . Retrieved March 28, 2023, from www150.statcan.gc.ca

Ray Punn

Vice President, Wealth Solutions

Skyline Wealth Management

Ray Punn is an experienced leader in management across the public and private sectors, including the Financial, Automotive, and Private Equity industries. As Vice President of Skyline Wealth Management, he leads a comprehensive team of Advisors, and oversees business operations, marketing, investment management, and investor relations. With a deep understanding of how each component of wealth management contributes to an exceptional investor experience, Ray and his teams focus on building long-term partnerships with Skyline Wealth Management’s valued investors.